Discover a comprehensive guide to overcoming financial setbacks with actionable strategies for budgeting, debt management, and income boosting. This article offers expert insights and practical steps to help you regain financial stability, build resilience, and secure a prosperous future. Navigate your financial challenges with confidence and clarity.

Introduction

Economic losses are a daily experience in people’s lives, and it crosses all levels of societal stratum. Whatever may range from joblessness, a medical bill, or even a global recession challenges, the capacity can be disorienting concerning financial security. The first action tend to be reactions of insecurity and confusion as people come to terms with shattered anticipations and visions. However, getting back to a normalcy, is not just about finding a fix that will make it all better, but a plan that will put out the flames and then some; it is about getting back on the horse, after falling off it and putting in place the necessary structure that shall prevent such a reversal in fortunes in the future.

In what follows, we will outline the most extensive guide on how to cope with financial difficulties. This guide is not about rendering a readiness and resilience merely to withstand a storm but to thrive after one. Thus, carrying out these steps, one may not only level with his/her expenses but also plan the further stable and wealthy life. The important thing is to go to this meeting without any preconceptions, with a strategy and with the commitment to putting it into effect.

1. Assessing the Situation

However, to start any recovery process it is very important to know how deep the occurred financial blow is and the reasons for it. This means a inspection of the environment, hence a take-stock of the options that are available. Start with determining the amount and the type of the loss—that is, whether one is facing a cut in revenue or increase in costs or a financial crisis that has used up all the money. It should also be helpful to review the current assets, liabilities and cash flow position to see where one stands.

When the situation is defined the next activity that should be taken to resolve the problem is to look for the basic causes of the situation. Maybe it was an individual occurrence, or may be part of a certain trend? This is a classic chicken and egg situation, but understanding this can assist in developing plans that address the monitoring and funding for the short-haul that also sets up the long-haul foundation. For instance, if the setback was as a result of losing a job, then work should be created on getting a new job probably stabilize and even get other sources of income to avoid future pitfalls. If it was because of increasing levels of debt, then reducing this becomes the issue of focus. The chain of reasoning at work here is straightforward and, indeed, is the very first one necessary for developing a strategy to recovery.

2. Creating a Realistic Budget

Budgeting is a very unpleasant process, and even the mention of the word causes many people to yawn or stretch out their legs and yawn, but in the process of development of severe financial crisis, it becomes the only weapon with which it is possible to fight for oneself. Creating a good budget is the key to financial recovery; it enables you get back on track by planning your spending. First of all, you have to record all revenues and all kind of expenses for a month and ideas about where each cent is spent. This process may show a number of spending habits or expenses that one might not have considered as being avoidable and thus can be done away with or minimized. Distinction is made here between the most pressing requirements such as food and shelter and on the other hand, those costs that can be reduced in lean periods.

After learning the amount that comes in and goes out, the next step is to attempt to sit down and modify the budget according to the reality of the availability of money. This may call for some cutting that is usually undesirable for instance, cutting down one’s expenditure, negotiating for bills or go out for cheap ways of meeting the expenses that are inevitable. The aim is to achieve a reasonable and, at the same time, reasonably achievable budget. This budget should enable you to feed, pay for your essentials, and begin the process of repaying your debts and rehabilitating your emergency fund. Always bear in mind that budget is never final and should be changed as often as your financial status does.

3. Prioritizing Debts and Obligations

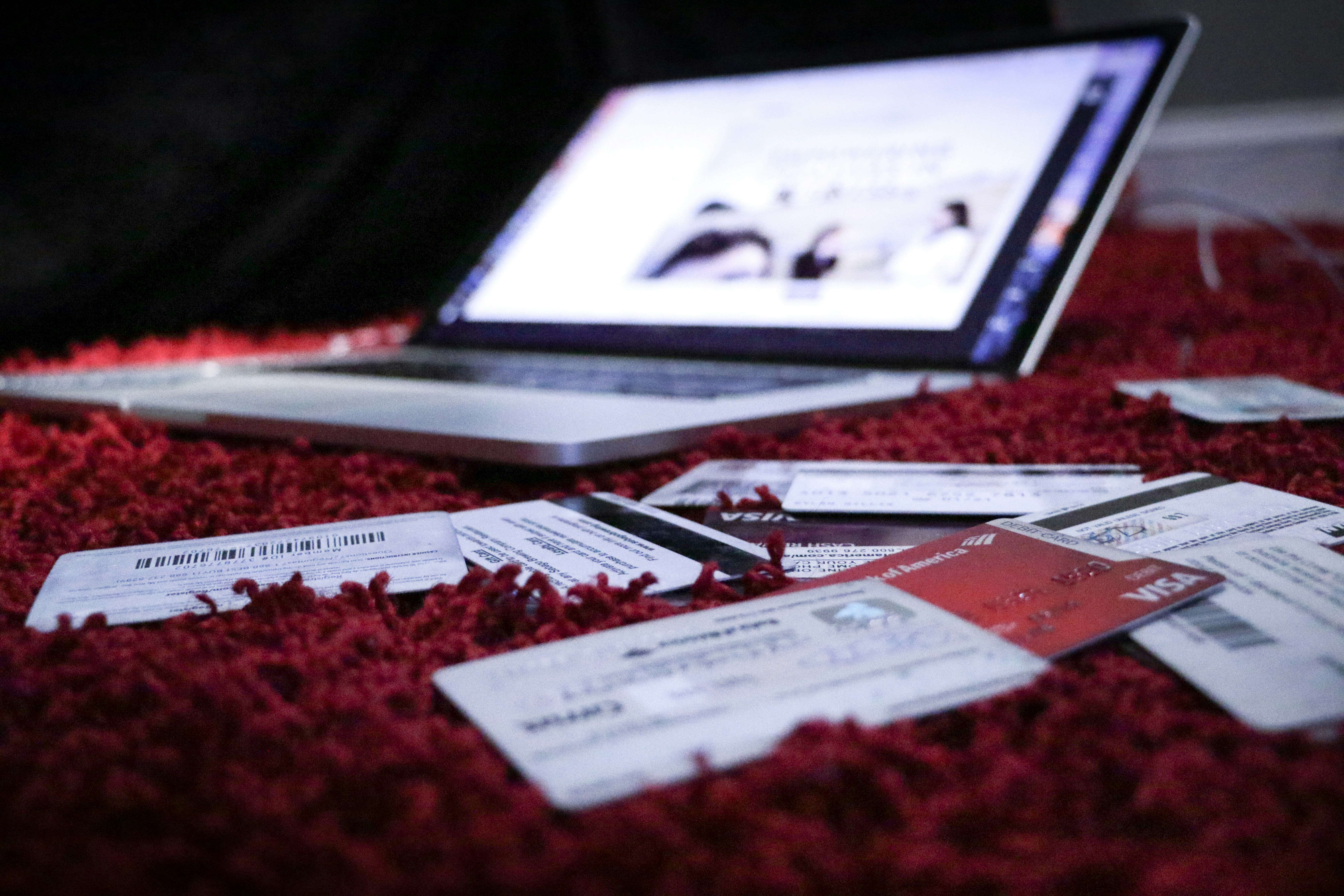

Failure can be terrible especially when it comes to paying bills and debt is confusing though paying attention to how it’s handled can go along way. The first step should be to prepare a balance sheet, wherein all the liabilities and debt that one has, whether in the form of, credit card, loans, mortgages or any other form of debt should be listed. Organize these debts by the rate of interest, the minimum amount of payment that one has to make and whether there are any penalty charges for failure to make payment on the agreed date. You will be able to see which of your debts is most expensive and where most of your money goes, this will help.

When you have outlined the different debts that you have it's recommended that you take some time and strategize on how to clear your debts. There are two most common strategies, namely, the debt snowball and the debt avalanche. The end of the pass strategy, also known as the debt snowball method means to pay off the smallest debts so that there are quick victories. The opposite strategy is the debt avalanche which focuses on the following high-interest debts first, which, of course, saves you even more money in the future. Depending on the one that you adopt, make sure that you do not miss crucial bills like housing and other utilities to cause additional problems. In the case that you need to, try to contact the creditors to enable you to get better deals. Such a preemptive strategy in relation to your debts may go a long way in easing the burden which you have on your shoulders and, therefore, bring order in your financial life.

4. Exploring Income-Boosting Opportunities

When one experiences any form of financial challenge, the best option of tackling this is by increasing the cash flow thereby enhancing the rate of recovery. This might include seeking for an eventual part time job, a consultancy or a second job that is related to what you are already gaining exposure in. The following is the breakdown of the gig economy services that can be an instant source of income in an emergency; Further, to increase the amount one is able to create regularly one should sell durable goods or property that is no longer of use. The following are some of the possible short-term measures to temporarily feed the habit while focusing on long-term measures on how to increase income sources.

Finally, upskilling or reskilling helps one to find a better job and be paid, more money in the long run. It is suggested that one should engage in online programs, get trained in some area, or attend seminars in a hot area. If you are jobless at the moment, this might the best chance to change your career, and move to a better and more promising field. Moreover, to obtain temporary financial help or depending on grants or community services, may be helpful. Not only do you lose less when the going gets tough, as you are able to recover swiftly because you are learning new things every day and taking multiple shots, but you are also creating a better life for yourself financially.

5. Building an Emergency Fund

An emergency fund is something like a cash bulwark against any further occurrences that may inevitably let things spin out of control. Although, it might appear nearly impossible to save money during the period of economic decline, it is important that one starts creating this fund as early as possible. It goes without saying that it is recommended to start with the sets of small and more realistic savings targets that are possible with the available financial means. Every dollar or two that is saved per week, when accumulated over time will set apart some money for emergencies. Such an approach can be made easier through automation in a way that a part of your earnings is automatically paid to your emergency fund without much input.

Ideally, to increase the prospects to meet emergencies in the future one must continue growing the fund to provide at least the basic expenses for a three to six months’ duration. This helps to protect future thresholds of financial reasonableness: e. g. , being laid off, or faced with unexpected medical expenses. When you begin to ascend the financial totem pole, maintain this fund as the holy grail even if you have to scrimp somewhere else. An appropriately funded emergency account isn’t merely reassuring; it also positions you to deal with future problems with more assurance. It’s important to point out that the objective of an emergency fund is to manage your money in such a way that it doesn’t put you into a lot of debt and distract you from your financial plans even when the unexpected occurs.

6. Seeking Professional Guidance

Managing personal finance pitfalls may at times be exhausting, both physically and or psychologically, which is why getting a professional opinion may go a long way in assisting. People such as financial advisors, credit counselors, and other credit related professionals can give advice that is unique to your circumstances and your needs. Counselors can work with you in creating a detailed recovery plan, dealing with the issue of debt, and even come alongside in the bargaining for your creditors. Hiring such skilled people can help plenty as they come with valuable insight and expertise that will transform the pace and quality of how a person bounces back from a financial blow.

It is always wise to take sufficient time and effort to invest in professionals of one’s own including the EI. See that the BT consultant or counselor has been in business, possesses the necessary academic background and is recommended by past clients. You will come across people willing to provide you with great advice, but they are in the business of ripping you off through fake or expensive firms That is why it is good to ensure that what you are being told, is what you need to do. Moreover, you should also think about getting well-informed on the topics of personal finance, either through books, online and normal courses and workshops. That way, the more info you would have the capacity to make right decisions in righting your financial situations and ensuring that you’ve clearly stood on a sound footing. With the help of the professional advice and your increasing experience you have the right map to begin and proceed with an effective solution of the existing or potential problems.

Conclusion

It is worthwhile to note that financial losses, despite being disadvantageous, are good for the development of financial muscle. It is impressive as you can see, following all the steps highlighted in this guide you can regain control over your situation and start the way to the recovery. Evaluating your financial position, developing an effective spending plan, ranking the debts, increasing the money, developing an emergency fund, and asking for help are the key points of this journey. These is characterized by commitment, patience, and preparedness to embrace change throughout the undertaking of each of the steps.

Finally, the process of recovering from financial disasters is not only about laying down the losses and moving forward—it is about constructing better future economy. The road that may be long will give the best chance when you make the best choices and follow the right strategies for the best outcome. Do not forget that when speaking of ‘recovery’ the question is not really how they get back to the initial state but how they get to the much better state after the shock. In this journey, you would want to keep an eye on the prize and aim at achieving what you initially set out to do, at the same time, revel each achievement as it comes.